You will receive your council tax bill for the year ahead by the end of March.

Request a copy of your bill

If you would like a copy of your council tax bill by email or as a paper copy, complete the online form.

The online form is currently unavailable due to essential maintenance. Please check back on this page at later date. We apologise for any inconvenience.

Sign up for paperless bills

You can go paperless by using your online account if you have one. If you do not have an account already you will need to register first.

If you do not manage your council tax online yet

If you are not signed up to manage your council tax online yet you can set up paperless billing when you register. To do this:

-

Register to manage your council tax online.

- Add council tax to your services and click next at the bottom of the page.

- Enter your council tax account number and click access now.

- Answer the security questions.

- Enter your email address.

- Click set up paperless billing.

- Verify your email address.

If you manage your council tax online already

If you manage your council tax online already you need to change your paperless billing preference. To do this:

- Sign in to your online services.

- Click online services in the top left hand side of the page.

- Click set up paperless billing.

- Confirm that you have read the terms and conditions

- Enter your email address

- Change your paperless billing preference to email with attachment.

- Verify your email address.

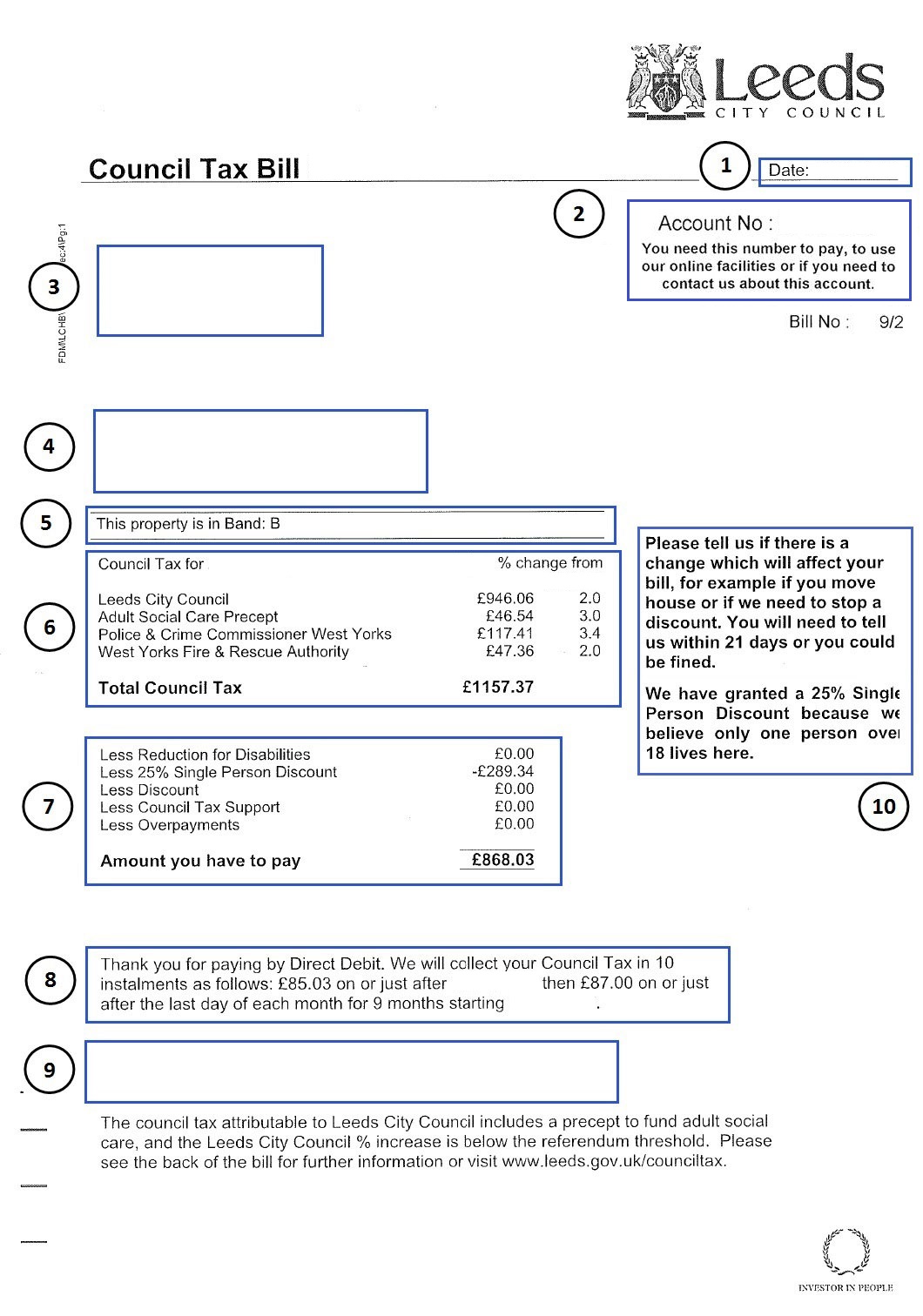

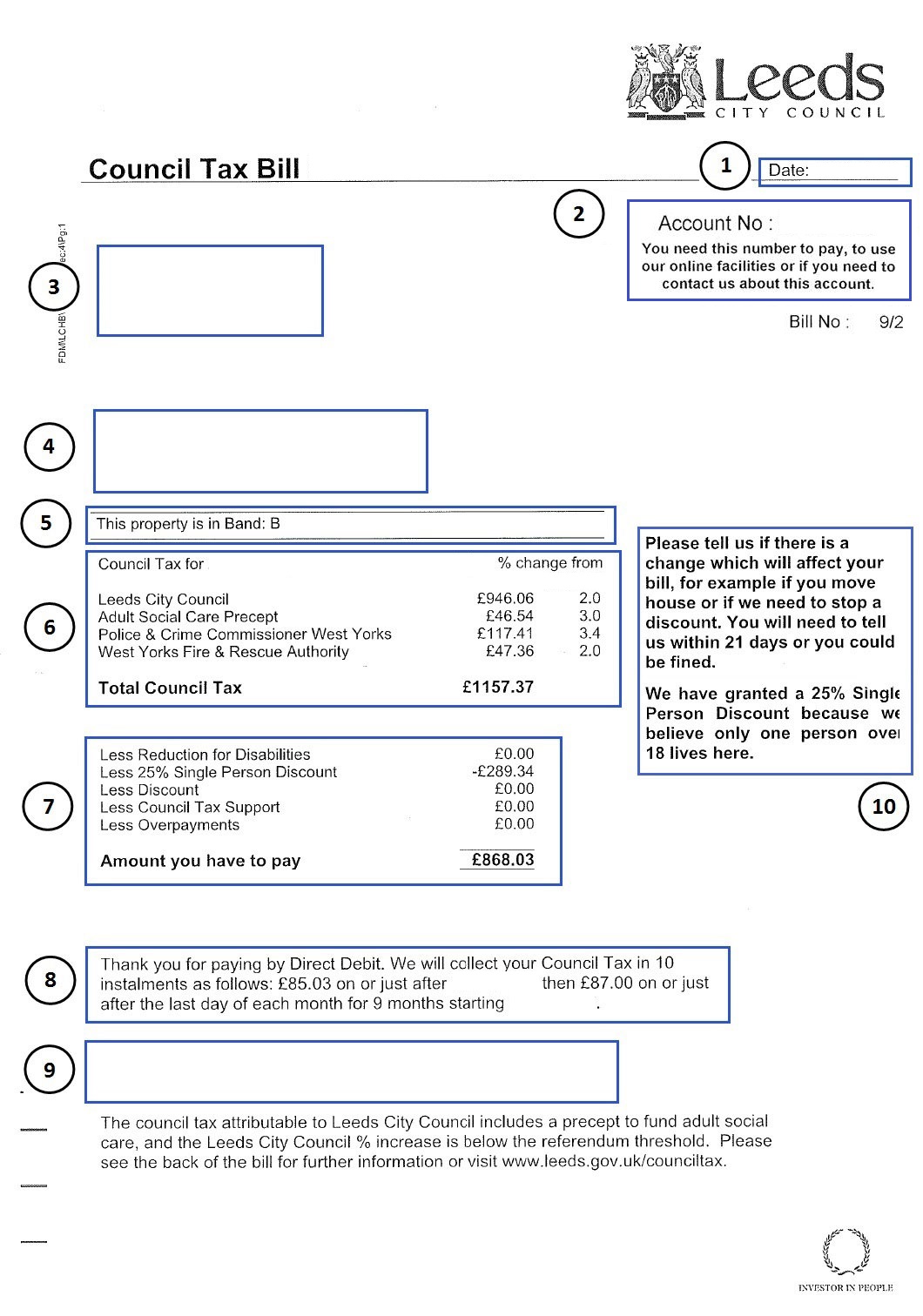

Understanding your council tax bill

Each numbered section is explained in detail after the image.

- The date your council tax bill was printed. Any payments made after this date will not be shown on this bill

- Your council tax account number. You must have this number if you want to talk to us about your bill

- Who is responsible for paying the bill, and their correspondence address

- If the bill is for a different property, that property address will be shown here

- The council tax band the property is in

- The annual charge for the property for the financial year shown, and also the percentage change from the previous year’s charges. It details your contribution towards council services, the fire service, police service and, if applicable, any additional town or parish council charges. If you will be moving out during this financial year, please let us know at the time of your move and we will adjust your bill.

- The amount you have to pay, any discounts, exemptions or premiums that apply, and any payments made towards this bill up to the issue date

- How you pay your bill, for example direct debit. If you pay by direct debit, the bill will confirm that here, and tell you the dates that your instalments will be collected

- Any charge outstanding from a previous year will be shown here. This will not take into account any payment you may have made towards a previous bill after the issue date of this bill

- Any discounts we’ve granted for the property – you will need to let us know if there is any change of occupiers, or if a discount no longer applies.